This tech entrepreneur’s journey is a rollercoaster of risk, resilience, and the unpredictable world of cryptocurrency.

Millennial and Gen-X women know a few things about navigating a challenging world. We’ve seen economic recessions, shifting career landscapes, and the constant pressure to hustle. But for all our grit, few of us can imagine the wild ride experienced by Michael Saylor, the tech CEO who became a Bitcoin billionaire.

Saylor’s story is one of extreme highs and lows. He founded software company MicroStrategy in the ’90s dot-com boom and became fabulously wealthy…until the bubble burst. In a single day, he lost $6 billion, a staggering setback for anyone. Yet, Saylor embodies what it means to be fierce – he rebuilt, reimagined, and ended up even more successful by taking a huge gamble on Bitcoin.

The Dot-Com Rollercoaster

Back in the 1990s, Michael Saylor was a tech-savvy entrepreneur with a vision. His company, MicroStrategy, was one of the darlings of the dot-com era. Unfortunately, like many tech businesses of that time, its success was built on hype and speculation. When the bubble popped in 2000, MicroStrategy’s shares plummeted, wiping out billions in wealth overnight.

This experience could have crushed Saylor’s spirit. However, as we know, fierce entrepreneurs don’t always play it safe. Instead of retreating, he doubled down. He reinvented MicroStrategy as a business intelligence company, finding stability and steady growth over the next two decades.

The Billion-Dollar Bitcoin Bet

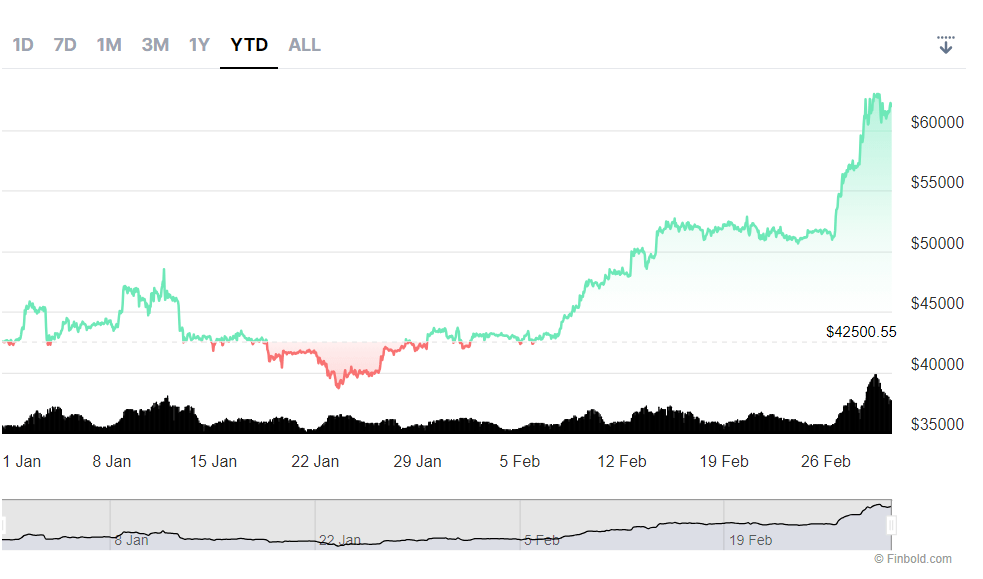

But Saylor wasn’t content with steady success. A true maverick, he had his eye on an emerging and highly volatile asset: Bitcoin. In 2020, he made a bold decision that shocked the financial world. Saylor used MicroStrategy’s cash reserves to invest heavily in Bitcoin. At the time, it was a controversial and risky move. Cryptocurrency was still largely unknown or viewed with distrust.

Yet, Saylor saw potential. He believes Bitcoin is a store of value, a hedge against inflation, and a potential disruptor of the traditional financial system. His bet paid off handsomely. As Bitcoin’s value skyrocketed, MicroStrategy’s stock price soared. Saylor became a Bitcoin billionaire, proving that sometimes, fortune favors the bold.

The Controversy and Criticism

Of course, Saylor’s Bitcoin bet hasn’t come without controversy. Critics argue that MicroStrategy’s heavy investment in crypto is too risky, tying the company’s fortunes to an asset that can swing wildly in value. Saylor remains unshaken, demonstrating that fierce entrepreneurs stand their ground and aren’t easily swayed by the opinions of others. He stands by his belief in Bitcoin and continues to accumulate more of the cryptocurrency.

Lessons from Saylor’s Journey

While few of us will face the billion-dollar ups and downs of Michael Saylor, his story offers valuable lessons for any millennial or Gen-X woman:

- Resilience is key: From losing billions to regaining your fortune, setbacks are inevitable. How you bounce back is what matters.

- Learn and adapt: The landscape changes quickly. Don’t cling to old ideas; be curious and stay ahead of the curve.

- Calculated risks: Assess opportunities, do your research, but don’t be afraid of smart, bold moves when the time feels right.

- Trust your instincts: If you believe in something passionately, have the confidence to follow your own path, even when others disagree.

Leave a comment