Low-Interest Loans, Pieds-à-Terre, and Other Strategies That Stretch the Gift Tax Limit

You Want to Help, But Uncle Sam Wants His Cut

Let’s be real—if you’re in a position to help your kids financially, you should be able to do it without the IRS lurking in the background, waiting to take a bite. But no, the government has rules on how much you can give before they start calling it a “taxable gift” and demanding a cut.

Does that mean you should throw your hands up and leave your kids to fend for themselves? Absolutely not. It just means you need to play the game the smart way. And lucky for you, I’m about to show you exactly how to give generously—without triggering the IRS’s radar.

The Gift Tax Limit: How Much Is Too Much?

Before we get into the workarounds, let’s talk numbers. Each year, the IRS lets you gift a certain amount per person without it counting toward your lifetime exemption. [What’s New – Estate and Gift Tax].

Copyright: Fizkes | Dreamstime.com

That’s cute for birthdays and holidays, but if you’re trying to help with tuition, a business venture, or a down payment on a home, that limit starts looking real small, real fast.

So how do you help without getting hit with a tax bill? You get creative.

1. The Low-Interest Loan Hack

Instead of giving your kid money, loan it to them—at a crazy low interest rate.

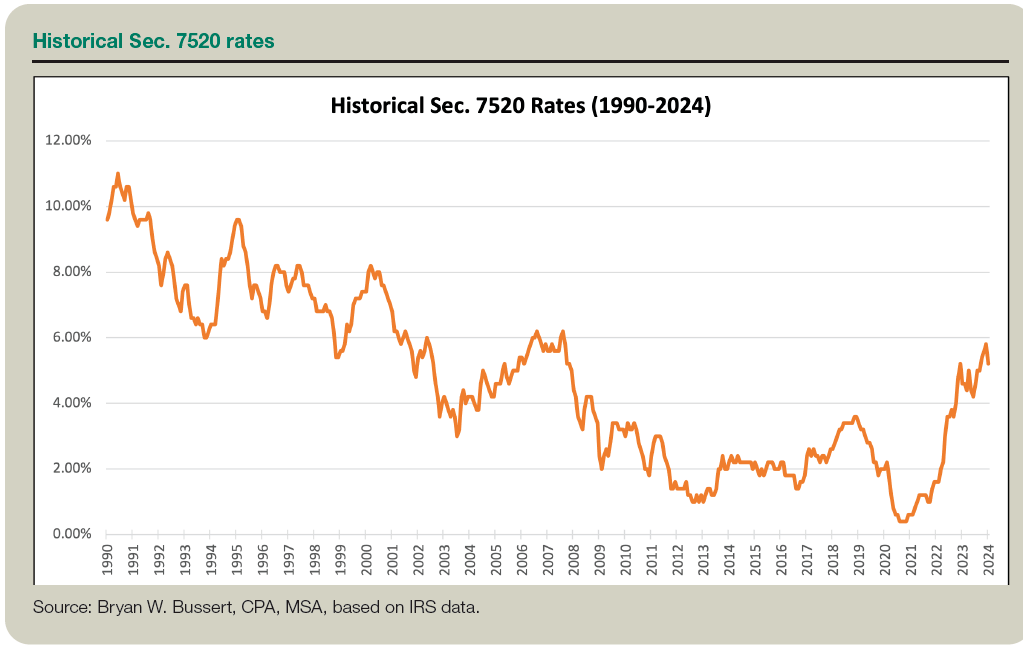

The IRS sets minimum interest rates (called the Applicable Federal Rate, or AFR), and as long as you charge at least that, the loan is considered legit. [IRS AFR Information].

Here’s why this works:

• Your kid gets a loan at a lower rate than any bank would ever give them.

• You stay within the rules, avoiding gift tax issues.

• They start building credit (because yes, they actually do need to pay you back).

Just make sure you treat it like a real loan—put it in writing. [Sample Loan Agreement Template].

2. The Pied-à-Terre Power Move

Got extra cash and want to help your kid put down roots? Buy a property and let them live there rent-free (or at a deep discount).

Why this is genius:

• Instead of handing them money outright, you’re investing in an appreciating asset.

• You can structure it as a rental, so there’s some income flow (or at least expense write-offs).

• If done right, it won’t count as a taxable gift.

Talk to a real estate or tax advisor first, though. The IRS loves to scrutinize “sweetheart deals,” so you want to get this right. [Real Estate Tax Center].

3. The 529 Plan Power Play

If college is in the cards, a 529 plan is the ultimate cheat code. These tax-advantaged education savings accounts let you stash away cash for tuition, books, and even some housing costs—all while dodging gift taxes.

Bonus: You can contribute a lump sum of five years’ worth of gifts in one go. [529 Plan Financial Advisor Resource].

If you were planning on helping with tuition anyway, this is a no-brainer.

4. The Trust Fund (Without the Trust Fund Kid Stereotype)

When people hear “trust fund,” they think spoiled rich kids. But trusts are actually a brilliant way to transfer wealth while keeping control.

There are tons of different types of trusts, each with its own tax benefits. [Information on Different Types of Trusts]. A common move is to set up an irrevocable trust and gradually transfer assets into it over time, reducing your taxable estate and avoiding gift tax headaches.

A trust also means your money is protected from:

• Bad financial decisions

• Shady business partners

• Divorce drama

But trusts aren’t DIY—get an estate planner involved. [Estate Planning Attorney Resource].

5. Pay the Bills Directly

This is one of the easiest ways to get around the gift tax:

✅ Tuition: If you pay a school directly, it doesn’t count as a taxable gift.

✅ Medical Bills: Same deal—if you pay the hospital or doctor instead of giving your kid the money, it’s all good.

So if your child is racking up student loans or medical expenses, consider covering the bill straight from your account to the institution. No gift tax. No problem. [IRS Information on Educational and Medical Exclusions].

Generational Wealth Is More Than Just Money

At the end of the day, giving your child financial help is amazing, but teaching them how to manage money is even better. Because what’s the point of handing them a bag if they don’t know what to do with it?

The real gift isn’t just cash—it’s financial literacy, discipline, and the ability to build on what you’ve started. If you do it right, they won’t just inherit wealth—they’ll grow it.

And that’s how you make Uncle Sam work for you instead of against you.

Disclaimer:

I’m not a financial advisor, tax professional, or estate lawyer. This article is for informational purposes only. Always consult with a qualified professional before making major financial moves.

Leave a comment