A No-B.S. Guide to Tax Withholding

Let’s Talk About Your Coins (Before the IRS Takes Them)

Taxes. They creep up like a toxic ex—showing up when you least expect them and demanding more than you’re ready to give. And let’s be real, most of us don’t think about our tax withholding until we get that “you owe” notice from Uncle Sam.

If you’ve ever been hit with a surprise tax bill (or an underwhelming refund), you know the struggle. But here’s the thing—you actually have control over how much gets taken out of your check. So before you rage quit your job over tax season drama, let’s get into how to make sure you’re not playing yourself when it comes to withholding.

What the Hell is Tax Withholding (And Why Should You Care)?

Tax withholding is that chunk of your paycheck that gets sent directly to the IRS before you even see your money. Your employer uses your W-4 form to figure out how much to withhold, but here’s the catch—if you filled that thing out on autopilot or haven’t updated it since your first job, you could be leaving money on the table (or worse, setting yourself up for an unexpected tax bill).

So, why does this matter?

• Too little withholding = Owing taxes (and possibly penalties)

• Too much withholding = Big refund (which means the IRS held your money interest-free all year)

• Getting it just right = Keeping more money in your paycheck while avoiding IRS drama

The goal is to make sure you’re not overpaying or underpaying—because who wants to give the government an interest-free loan when that money could be growing in your savings or investment account?

Step 1: Use the IRS Withholding Calculator (Seriously, Just Do It)

First things first—grab your latest pay stub and head over to the IRS Tax Withholding Estimator. This free online tool will break down exactly how much should be taken out of each paycheck so you’re not hit with surprises later.

Here’s what you need to plug in:

✅ Your filing status (Single, Married, Head of Household, etc.)

✅ Your income details (salary, side hustle money, etc.)

✅ How much is already being withheld from your paycheck

✅ Any tax credits or deductions you qualify for

Once you run the numbers, the estimator will tell you whether you’re on track or if you need to adjust your W-4.

Step 2: Fix That W-4 (Because It’s Probably Wrong)

Most people fill out their W-4 when they start a job and never think about it again. That’s a mistake. If your life has changed (new job, marriage, side hustle, a baby, or even a raise), your W-4 probably needs an update.

How to tweak it for your situation:

💰 If you want a bigger paycheck now → Reduce withholding by claiming the right number of dependents and tax credits.

⚖️ If you want to break even at tax time → Adjust your withholding to match what you actually owe, using the IRS estimator as a guide.

🛑 If you’re tired of owing money every year → Have extra tax withheld from each paycheck or claim fewer allowances.

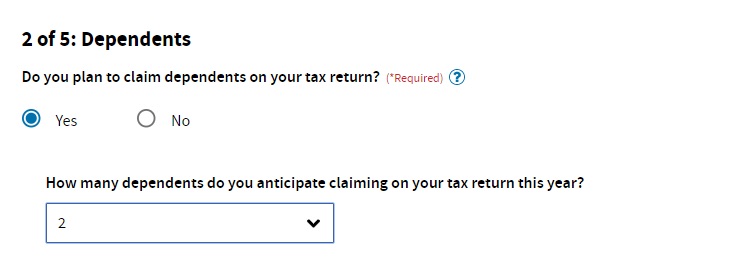

Need help filling it out? Here’s a step-by-step guide to filling out your W-4.

Step 3: Factor in Your Side Hustle (Because the IRS Is Watching)

If you’re making money outside of your 9-to-5—whether it’s freelancing, consulting, or running a business—your paycheck withholding isn’t covering all of your income. The IRS doesn’t care that your side hustle money is “extra” to you; if you don’t pay taxes on it throughout the year, you could owe a fat bill (plus penalties).

How to cover your bases:

✅ Make estimated tax payments (Use IRS Form 1040-ES)

✅ Adjust your W-4 to withhold extra to cover side hustle income

✅ Track every expense (Because deductions = lower tax bill)

Step 4: Check Your Withholding at Least Once a Year

Your tax situation isn’t set in stone. Major life events like getting married, having kids, or getting a raise can throw off your withholding—so check in at least once a year (preferably in the fall) to make sure you’re still on track.

Life events that should trigger a W-4 update:

✔️ New job or raise

✔️ Marriage or divorce

✔️ Having a baby

✔️ Buying a home

✔️ Side hustle taking off

Think of your W-4 like your budget—it needs adjusting as your money situation changes.

The “Quick & Dirty” Hack to Avoid Tax Season Shock

If you don’t have time to deep dive into tax calculators and withholding tables, here’s a simple hack:

📝 Claim 0 or 1 allowance on your W-4 if you want the most tax withheld (less take-home pay but no tax bill later).

📊 Claim 2+ allowances if you want more money in your paycheck but may owe at tax time.

📢 Tell payroll to withhold an extra flat amount per check if you’ve got side hustle money coming in.

This isn’t the most precise way, but if you just want to make sure you’re not owing the IRS come tax season, it gets the job done.

Final Takeaway: Stop Letting the IRS Play You

The goal isn’t to get a massive refund (that’s just money the government borrowed from you for free). The goal is to keep as much of your paycheck as possible while making sure you don’t owe at tax time.

Take 10 minutes today to check your withholding. Future you will thank you.

Now, go on and secure your bag—without giving Uncle Sam his unnecessary cut.

Leave a comment