Financial stress is real and relentless, but your peace of mind doesn’t have to be collateral damage. Here’s how to protect your mental health when money woes start weighing heavy.

Let’s be honest for a hot minute. Adulting is a damn rollercoaster, and somewhere between chasing that promotion, dodging student loan collectors, and trying to maintain some semblance of a social life, money stress can sneak up and sucker-punch your mental health. One minute you’re planning a cute weekend getaway, the next you’re staring at your bank balance like it personally insulted your entire existence. Sound familiar? You’re not alone.

The truth of it all is this: your financial well-being and your mental well-being are tighter than those jeans you swore you’d fit into again. When one takes a nosedive, the other is usually right there to catch the splash damage. We’re talking anxiety that feels like a permanent resident in your chest, sleepless nights spent doing mental gymnastics with your debt, and a general cloud of “can’t afford it” hanging over everything you try to enjoy.

According to a recent report on NPR, the connection between financial strain and mental health struggles is undeniable. Job loss, unexpected expenses, and the constant pressure of making ends meet can trigger or exacerbate conditions like anxiety and depression. It’s not just about the numbers in your account; it’s about the weight that those numbers place on your shoulders, the feeling of being trapped, and the fear of an uncertain future.

But listen, this isn’t a doom-and-gloom session. We’re here to arm you with some real, actionable steps to tackle that financial stress head-on and start reclaiming your mental peace. Consider this your fierce friend giving you a much-needed pep talk and a solid plan of attack.

Step 1: Face the Beast – Know Your Numbers (No Hiding!)

Ignoring your financial situation is like putting a designer bandage on a gaping wound – it looks marginally better for a second, but the real damage is still there, festering. The first bold move is to get crystal clear on your financial landscape. We’re talking about a deep dive into your income, your expenses (yes, every single overpriced latte counts!), and your debts.

Grab a notebook, fire up a spreadsheet (if you’re feeling fancy), or download a budgeting app. Track your spending for a month. Seriously, every dollar. You might be surprised (and maybe a little horrified) at where your money is actually going. Once you have a clear picture, you can start to identify areas where you can cut back and areas where you absolutely can’t.

Next, confront your debts. List them out – the total amount owed, the interest rates, and the minimum payments. Seeing it all in black and white can be intimidating, but it’s the first step towards taking control.

Step 2: Craft Your Battle Plan – The Budget That Doesn’t Suck

The word “budget” can sound about as exciting as a root canal, but think of it as your financial roadmap to freedom. A good budget isn’t about deprivation; it’s about making conscious choices about where your hard-earned money goes so that it aligns with your priorities and values.

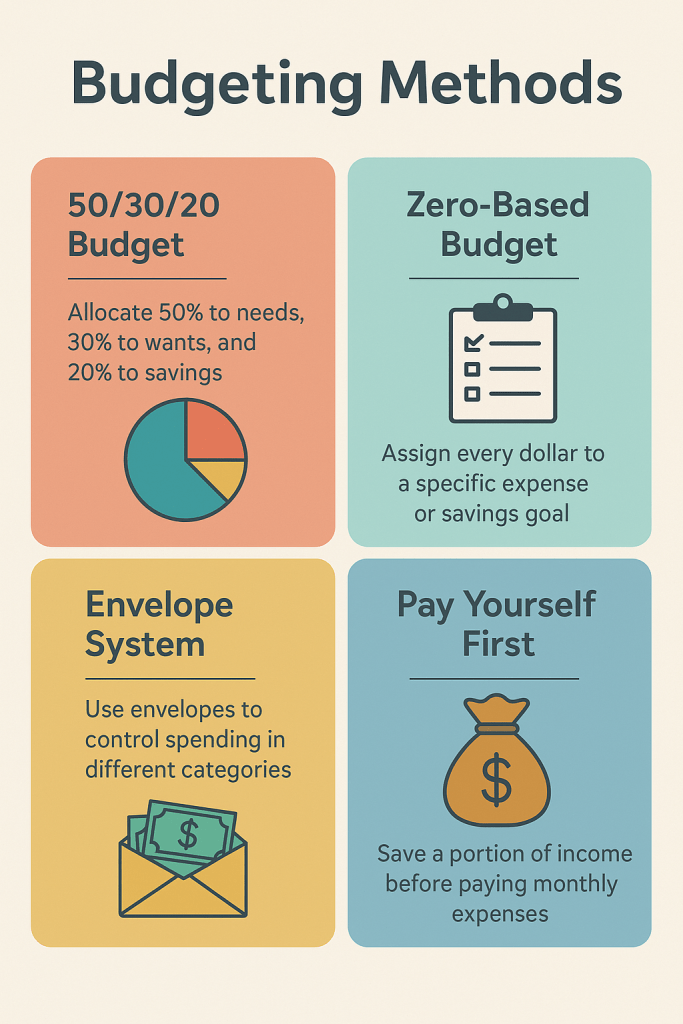

There are tons of budgeting methods out there – the 50/30/20 rule, zero-based budgeting, the envelope system. Find one that clicks with your personality and lifestyle. The key is to create a plan that is realistic and sustainable. Don’t set yourself up for failure by making it so restrictive that you feel like you’re living on air and good intentions.

Allocate funds for your essentials (rent, food, transportation), your debts (prioritizing high-interest ones), your savings (even small amounts add up!), and yes, even some fun money. Because let’s be real, all work and no play makes for one seriously stressed-out human.

Step 3: Build Your Fortress – Emergency Fund Power

Life throws curveballs. The car breaks down, the fridge decides to stage a dramatic exit, or an unexpected medical bill lands in your lap. These financial surprises can send even the most meticulously planned budget into a tailspin and crank up your stress levels to DEFCON 1.

That’s where an emergency fund comes in. This is your financial fortress, a cushion of cash specifically set aside for those “oh snap!” moments. Aim for at least 3-6 months’ worth of essential living expenses. It might seem like a daunting goal, but start small and build gradually. Even saving a little bit each month can provide a significant sense of security and reduce anxiety about the unexpected.

Step 4: Seek Backup – Don’t Be Afraid to Ask for Help

Talking about money can feel incredibly vulnerable, especially when you’re struggling. But isolating yourself in your financial worries will only amplify the stress. Reach out to trusted friends or family members who you know are financially savvy and supportive. Sometimes just voicing your concerns can provide a huge sense of relief.

Consider seeking professional help. A financial advisor can provide personalized guidance on budgeting, debt management, and investment strategies. A therapist or counselor can help you address the emotional toll that financial stress is taking on your mental health. There’s no shame in admitting you need support – in fact, it’s a sign of strength.

[National Alliance on Mental Illness]

Step 5: Practice Self-Care That Doesn’t Break the Bank

When you’re stressed about money, the idea of spending more on “self-care” might feel counterintuitive. But neglecting your mental and physical well-being will only make it harder to tackle your financial challenges. The good news is that self-care doesn’t have to be expensive.

Think about activities that genuinely help you de-stress and recharge. This could be going for a walk in nature, listening to your favorite music, practicing mindfulness or meditation (there are tons of free apps!), spending quality time with loved ones, or engaging in a hobby you enjoy. Prioritize these activities, even if it’s just for a short time each day. Remember, taking care of yourself is an investment, not an expense.

Step 6: Reframe Your Mindset – Money Doesn’t Define You

It’s easy to let your financial situation dictate your self-worth. You might feel like a failure if you’re struggling with debt or not earning as much as you think you “should” be. But here’s a crucial reminder: your financial status does not define your value as a person.

Focus on your strengths, your skills, and the things you can control. Celebrate small victories along the way – paying off a small debt, sticking to your budget for a week, increasing your savings. Cultivating a more positive and resilient mindset can make a huge difference in how you cope with financial stress.

The Bottom Line

Financial stress is a heavy burden, and it’s okay if you’re feeling the weight of it. But remember that you don’t have to carry it alone. By taking proactive steps to understand your finances, create a plan, seek support, and prioritize your well-being, you can start to alleviate that pressure and reclaim your mental peace. You are fierce, you are capable, and you absolutely deserve to feel good, both in your bank account and in your mind. Now go out there and take control – your future self will thank you.

Leave a comment