It’s a frustrating paradox of adulting – working hard to pay off debt only to discover your credit score takes a dive.

The Credit Score Conundrum: Why Being Debt-Free Can Hurt Your Score

Let’s be real, the credit score system can feel frustrating and nonsensical. You finally pay off a major loan – a serious financial achievement – only to see your score go down instead of up. What gives?

This is exactly what happened to a person who recently went viral after their credit score dropped after finally paying off his car. He took to social media to vent his understandable frustration, opening up a broader conversation about the seemingly flawed nature of credit scores.

How Does Paying Off Debt Hurt Your Credit Score?

While it seems counterintuitive, there are a few reasons why becoming debt-free can temporarily ding your credit score:

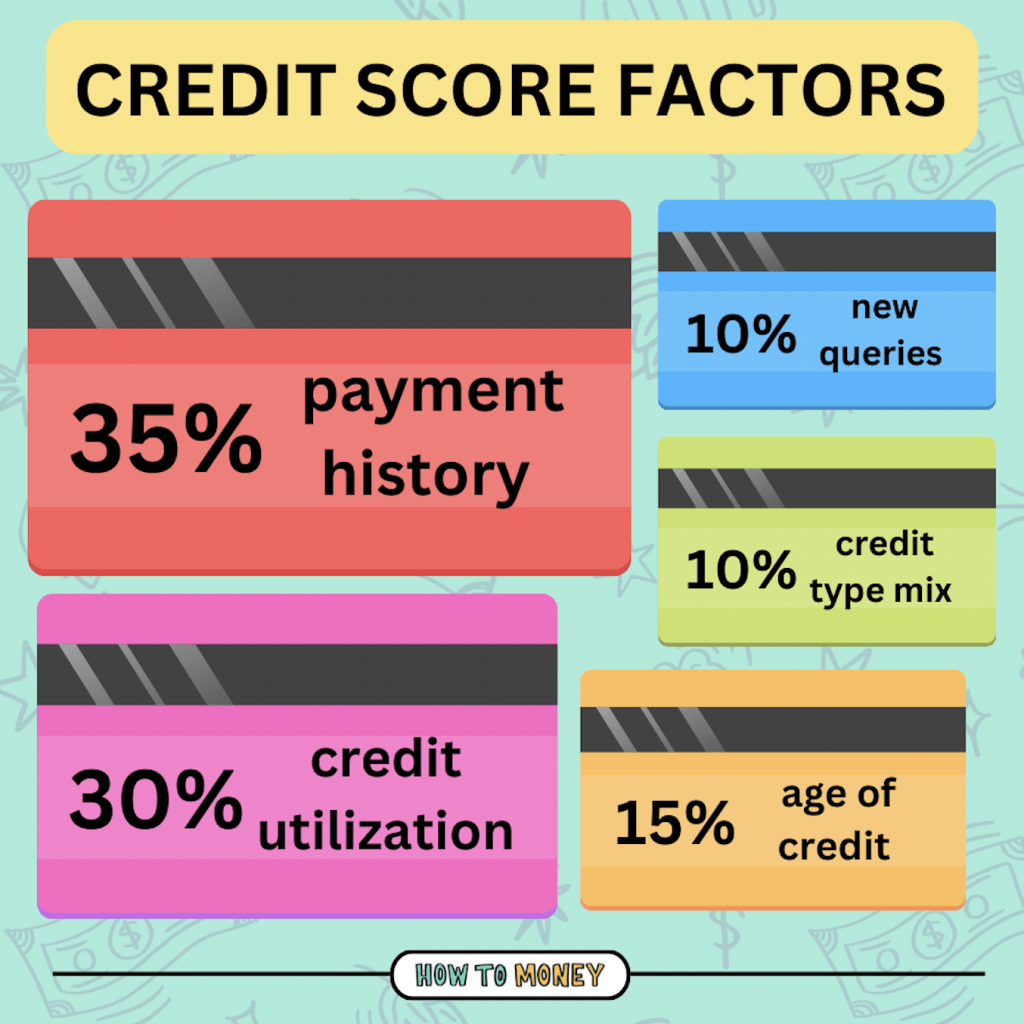

- Credit Utilization Ratio: This measures how much of your available credit you’re using. When you pay off a big loan, your credit utilization goes down (which is generally positive), but a sudden, significant drop can raise a flag for lenders.

- Account Mix: Lenders like to see that you can handle different kinds of credit (e.g., revolving credit like credit cards, and installment loans like car payments). Without an installment loan in the mix, your score may dip.

- Account Age: The length of your credit history matters. Closing an old account, even if it’s paid off, can lower the average age of accounts on your report.

Does this Mean the System is Rigged?

While it’s tempting to write off the whole credit score system as a scam, the truth is more complicated. The credit scoring system certainly isn’t perfect, and it does seem to prioritize a consistent pattern of debt over total debt load.

However, it’s important to remember that credit scores are designed to predict how reliably you pay back borrowed money, not to reward your financial prudence.

What Can You Do?

Don’t let a temporary drop in your credit score derail your financial goals. Here’s how to handle debt payoff while protecting your credit:

- Keep Accounts Open: If possible, avoid closing the credit line even after it’s paid off.

- Maintain Low Utilization on Cards: Continue using credit cards responsibly and pay down balances regularly.

- Focus on the Long Game: Credit scores fluctuate, and a temporary dip shouldn’t cause major panic. Over time, responsible financial habits will help you build strong credit history.

Leave a comment